Financial Information

Quarterly Report For The Financial Period Ended 31 December 2025

Download PDF

Financials Archive

View More

Notes:

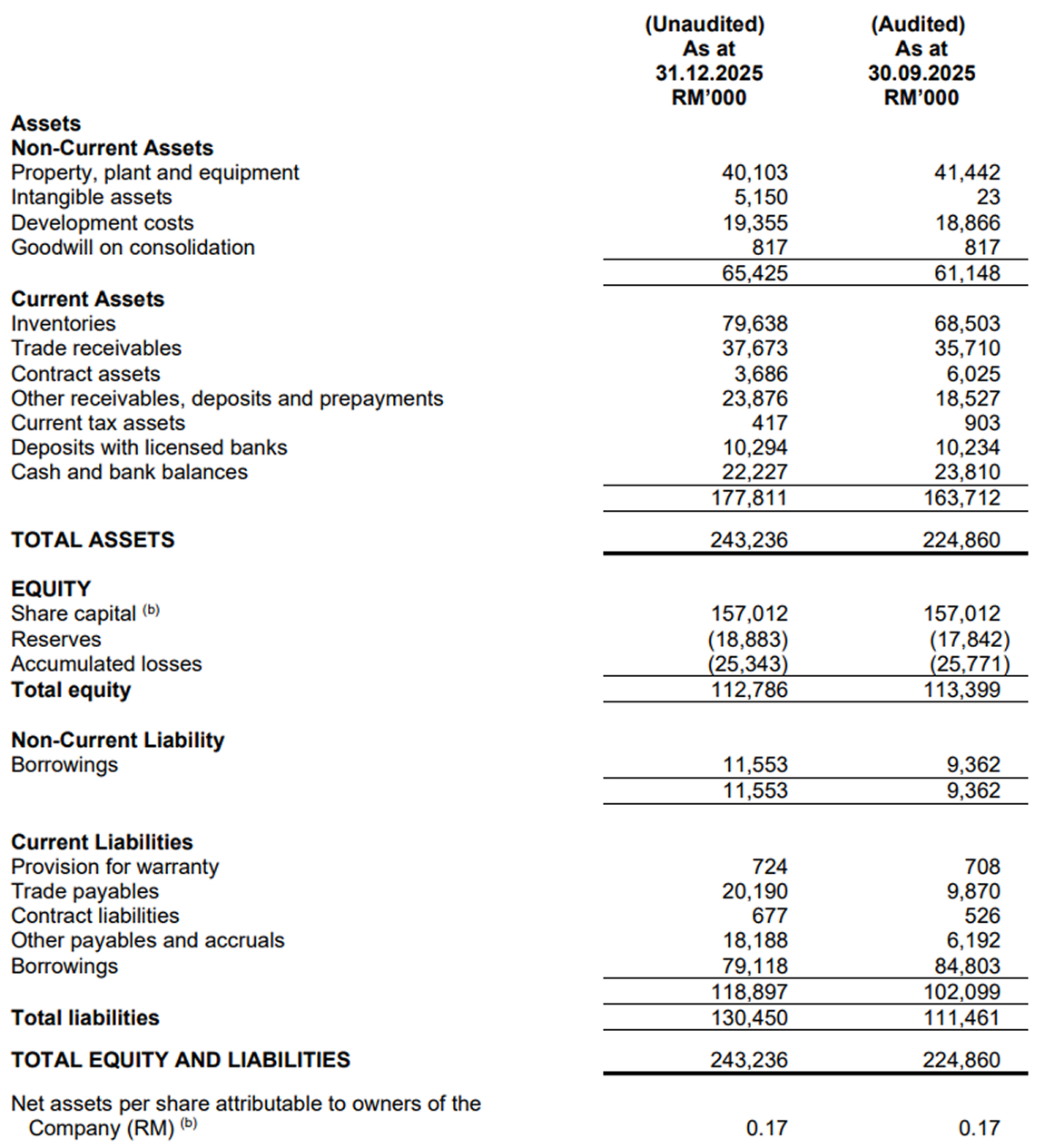

(a) The unaudited condensed Consolidated Statement of Financial Position should be read in conjunction with the audited financial statements for the financial year ended 30 September 2025 and the accompanying explanatory notes attached to this interim financial report.

(b) Based on 672,590,047 ordinary shares in issue as disclosed in Note B11.

Notes:

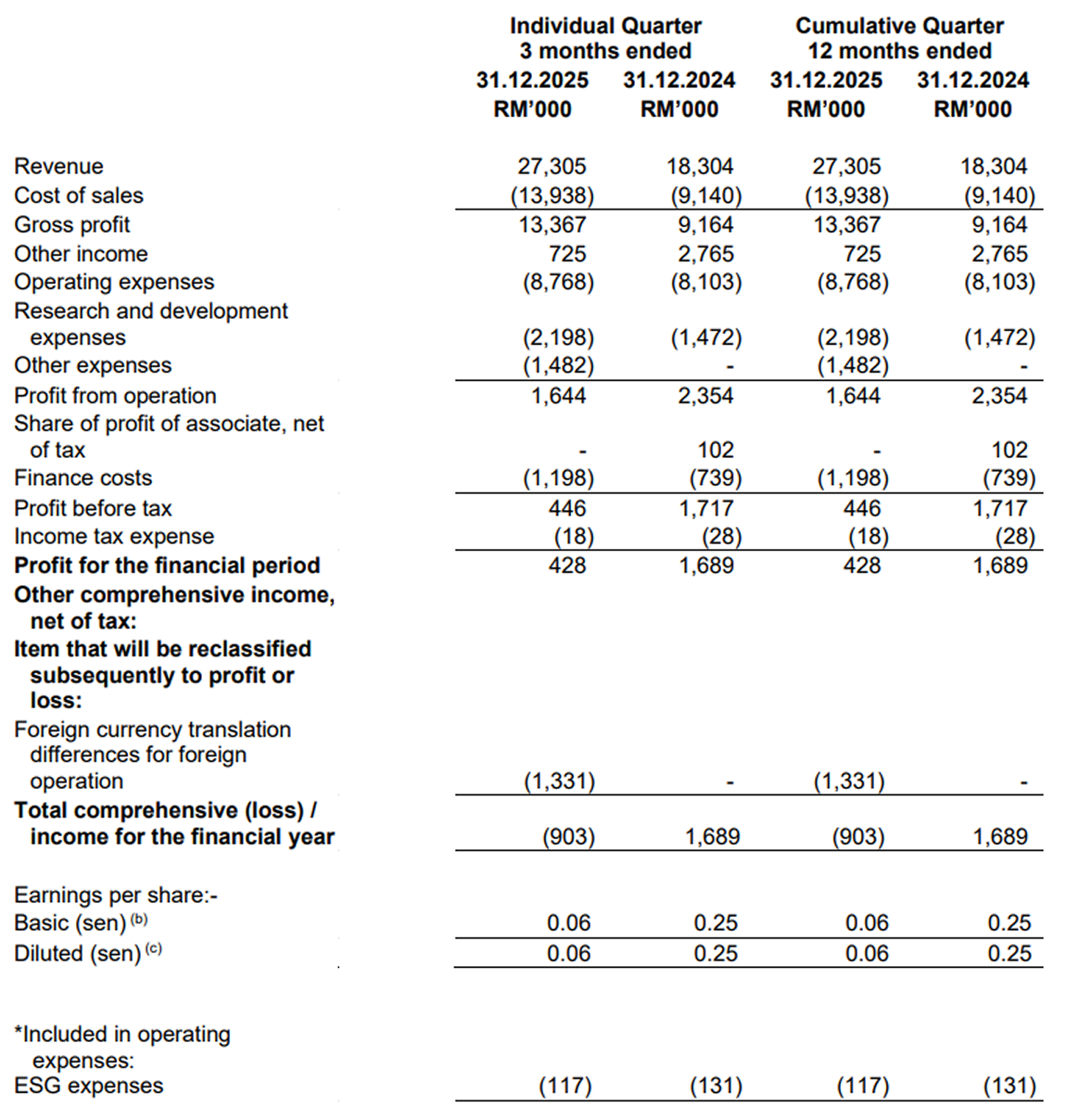

(a) The Unaudited Condensed Consolidated Statement of Profit or Loss and Other Comprehensive Income should be read in conjunction with the audited financial statements for the financial year ended 30 September 2025 and the accompanying explanatory notes attached to this interim financial report.

(b) Based on 672,590,047 ordinary shares in issue as disclosed in Note B11.

(c) Diluted earnings per share for the current financial period is calculated by dividing the profit for the financial period attributable to owners of the Company by the weighted average number of ordinary shares outstanding during the financial period adjusted for the effects of dilutive potential ordinary shares as disclosed in Note B11.

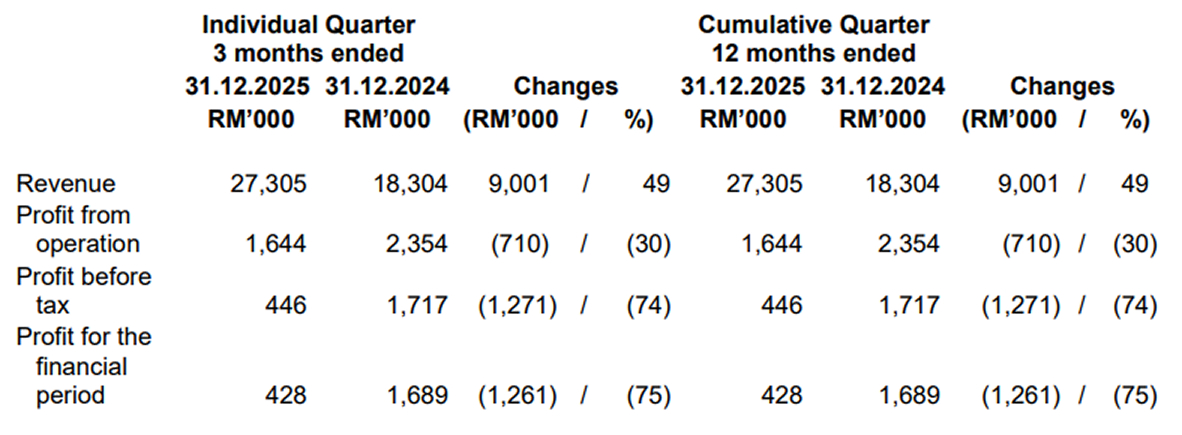

Comparison with the preceding year corresponding quarter and the corresponding financial period to date in the previous financial year

The Group achieved a 49% increase in revenue for the current quarter (Q1FY26) compared to the corresponding quarter last year (Q1FY25), driven by surging demand in the China market and strong performance across key sectors - specifically CIS, automotive and mobile/tablets.

A major driver of this growth is the successful integration of the Revotronix business (The Transfer of Business from Revotronix as announced in August 2025). To fully capitalize on this momentum, we strategically scaled our operations, including a one-off investment of RM500k to secure critical key talent.

Furthermore, we are accelerating our R&D activities and onboard key engineers from Revotronix to capture emerging CIS market opportunities. Hence, the R&D expenses increased from RM1.4m to RM2.1m during the quarter.

As a result, the Group recorded RM0.43m profit for the current quarter.

We expect the revenues in Q2'26 to be consistent with the previous quarter. However, the long holidays may delay some of our shipments.

In general, we see constant demands from all market segments. The revenue contribution from the rest of the world (ROW) market region shall lead the China market region due to the long Chinese New Year holidays observed in China. The enterprise storage/AI market segment continues to be active, signalling a rise of contribution to our revenues going forward.

We foresee new business opportunities in test automation, which is something we are actively engaging in now. We strive to deliver a better performance for FY2026.