89

AEMULUS HOLDINGS BERHAD

TA R G E T I N G T H E B U L L’ S E Y E

27. FINANCIAL INSTRUMENTS (Cont’d)

27.3 Fair value information

GROUP AND COMPANY

Other than the other investment disclosed below, the carrying amounts of the financial assets and financial liabilities

of the Group and of the Company as at the end of the reporting period approximate their fair values due to their

short term nature.

The carrying amounts of the non-current portion of trade receivables are reasonable approximation of their fair

values due to the insignificant impact of discounting.

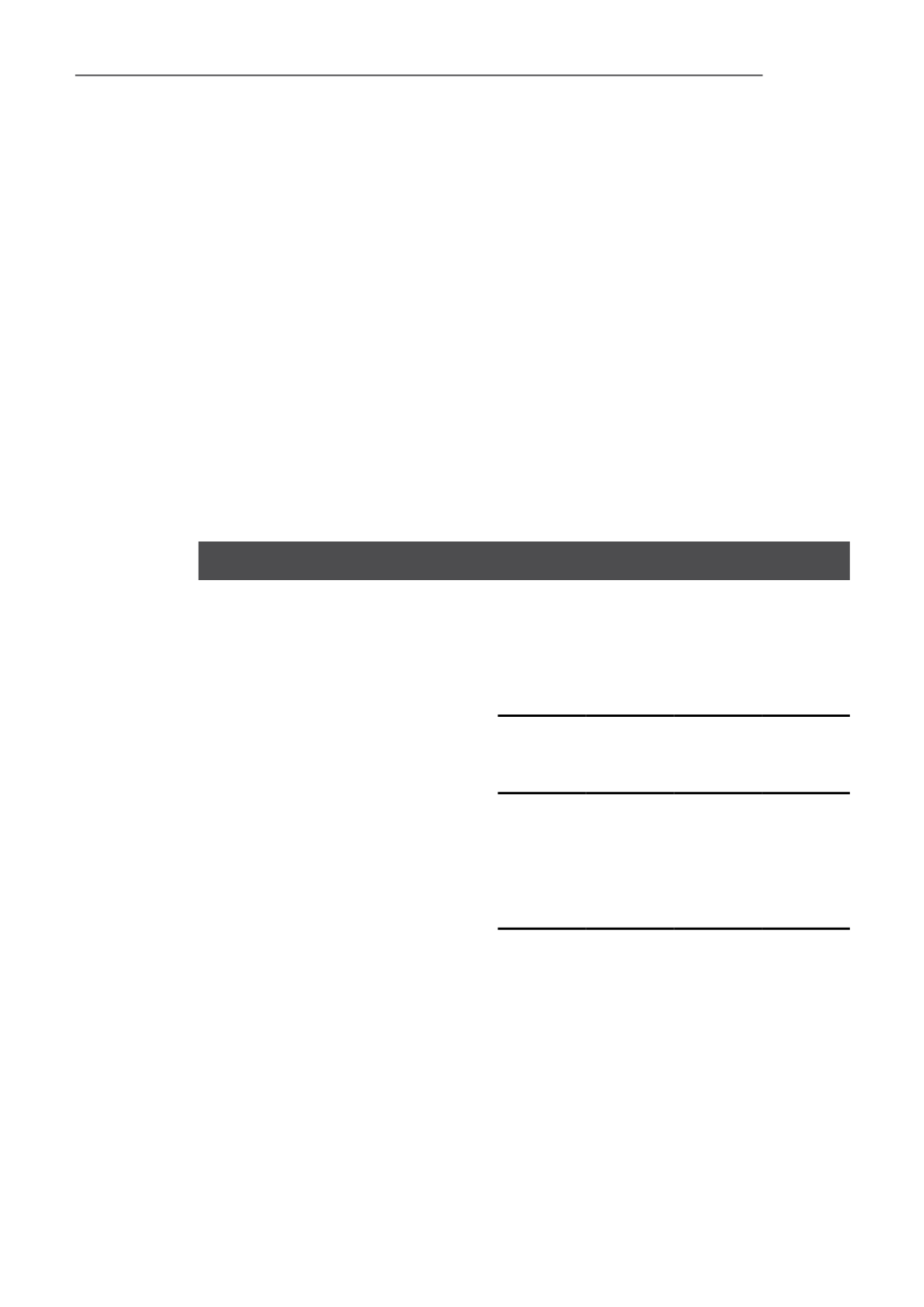

27.3.1 Fair value hierarchy

The table below analyses financial instruments that are measured subsequent to initial recognition at fair

value, grouped into Levels 1 to 3 based on the degree to which the fair value is observable (refer to Note

2.2 to the financial statements for definition of Level 1 to 3 fair value hierarchy).

Level 1

Level 2

Level 3

Total

RM

RM

RM

RM

GROUP

30.9.16

Available-for-sale financial assets

- Other investment

22,849,433

–

– 22,849,433

30.9.15

Available-for-sale financial assets

- Other investment

646,604

–

–

646,604

COMPANY

30.9.16

Available-for-sale financial assets

- Other investment

14,880,333

–

– 14,880,333

The other investment represents investment in unit trusts and it is carried at fair value by reference to its

quoted closing bid price at the end of the reporting period.

28. CAPITAL MANAGEMENT

The primary objective of the Group’s capital management policy is to maintain a strong capital base to support its

businesses and maximise shareholders’ value.

The Group manages its capital structure and make adjustments to it in the light of changes in economic conditions

or expansion of the Group. The Group may adjust the capital structure by issuing new shares, returning capital to

shareholders or adjusting the amount of dividends to be paid to shareholders or sell assets to reduce debts. A bank of

the subsidiary has imposed a debt covenant whereby the subsidiary’s gearing ratio shall not exceed

1

(30.9.15: 1). The

subsidiary has not breached this covenant as it is in a net cash position.

NOTES TO THE FINANCIAL STATEMENTS

(Cont’d)

– 30 SEPTEMBER 2016