81

AEMULUS HOLDINGS BERHAD

TA R G E T I N G T H E B U L L’ S E Y E

21. TAXATION (Cont’d)

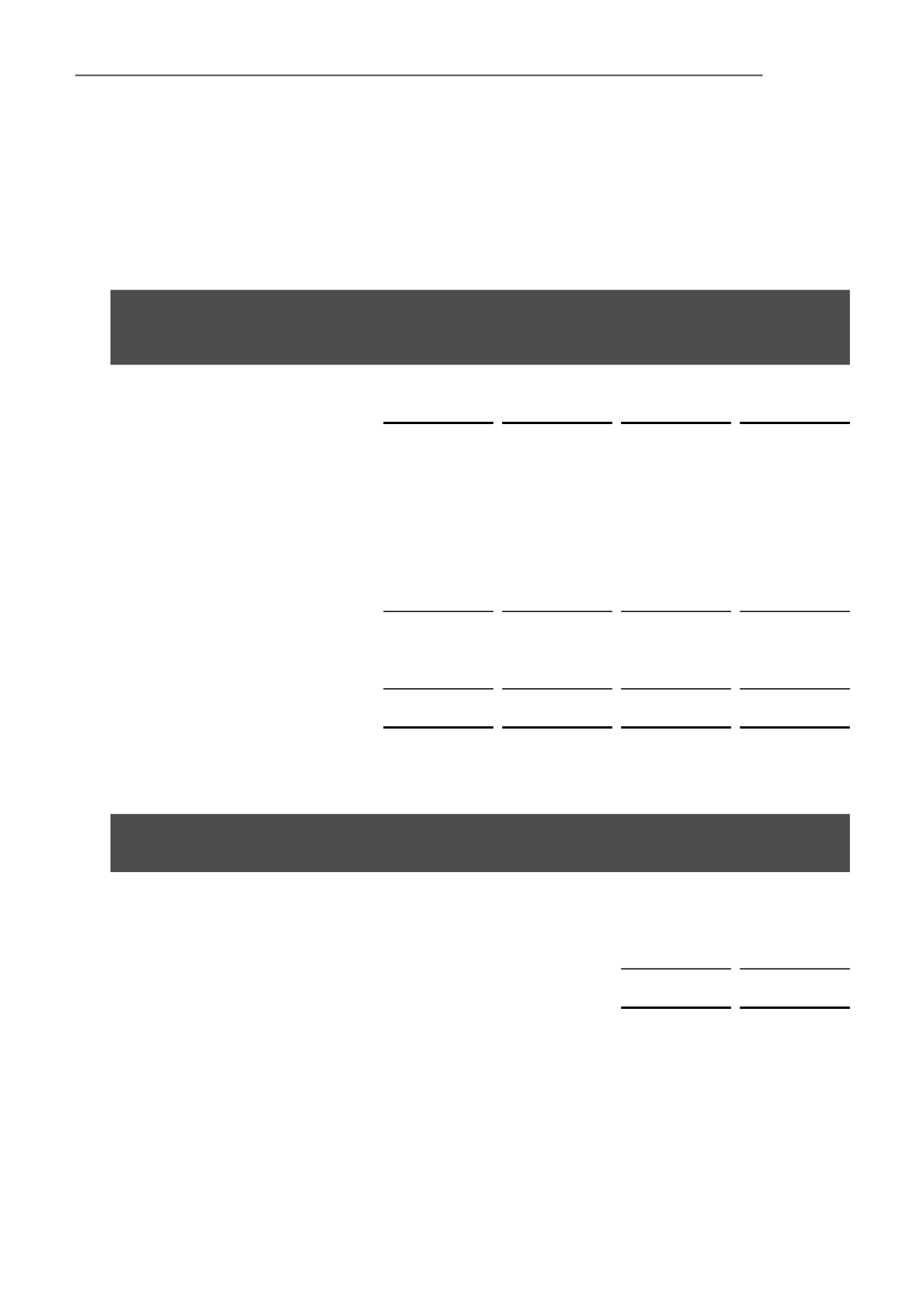

The reconciliation of tax expense of the Group and of the Company is as follows:

GROUP

COMPANY

1.10.15

to 30.9.16

17.10.14

to 30.9.15

1.10.15

to 30.9.16

17.10.14

to 30.9.15

RM

RM

RM

RM

(Loss)/Profit before taxation

(2,654,260)

9,101,751

109,055

(1,194,105)

Income tax at Malaysian statutory

tax rate of

24%

(2015: 25%)

637,023

(2,275,438)

(26,173)

298,526

Effects of :-

Expenses not deductible for tax purposes

(609,432)

(437,223)

(134,917)

(305,701)

Income not subject to tax

115,885

278,004

86,486

–

Pioneer income not subject to tax

–

2,365,778

–

–

Different of tax rate of other jurisdiction*

4,188

–

–

–

Net deferred tax movement

not recognised

(260,880)

30,865

–

–

(113,216)

(38,014)

(74,604)

(7,175)

Over provision in prior year

32,457

3,296

7,175

–

(80,759)

(34,718)

(67,429)

(7,175)

* The subsidiary’s Taiwan branch is subject to corporate tax rate of 17%.

The deferred tax movement not recognised is in respect of temporary difference arising from the following:

GROUP

30.9.2016

30.9.2015

RM

RM

Property, plant and equipment

1,315,000

1,139,000

Provisions

320,000

(171,000)

Unabsorbed capital allowance

(906,000)

–

Unabsorbed tax loss

(848,000)

–

(119,000)

968,000

The subsidiary of the Group had obtained the Multimedia Super Corridor status with pioneer status tax incentive. Under

this tax incentive, 100% of the statutory income derived from the design and assembly of automated test equipment

and test and measurement instruments and the provision of related design consultancy services, will be exempted from

income tax up to 7 September 2018.

NOTES TO THE FINANCIAL STATEMENTS

(Cont’d)

– 30 SEPTEMBER 2016