34

AEMULUS HOLDINGS BERHAD

A N N U A L R E P O R T 2 0 1 6

Additional Compliance Information

1. Material Contracts Involving Directors, Chief Executive or Major

Shareholders’ Interest

There were no material contracts entered into by the Company and its subsidiary involving interests of the Directors,

chief executive who is not a director or major shareholders, either still subsisting at the end of the financial year or

entered into since the end of the previous financial year.

2. Recurrent Related Party Transactions of a Revenue or Trading Nature

There was no recurrent related party transaction of a revenue or trading nature during the financial year ended 30

September 2016.

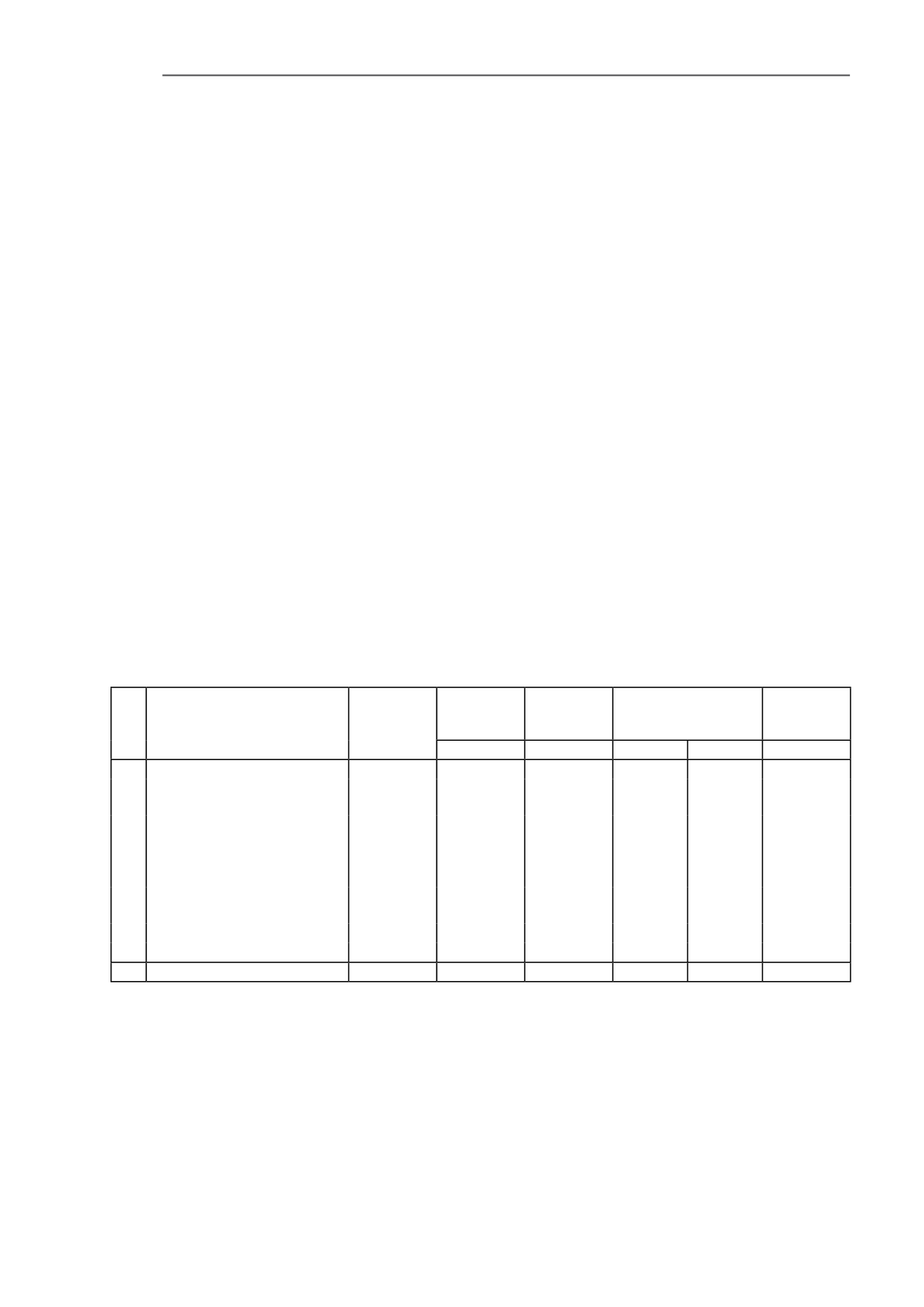

3. Utilisation of Proceeds

The listing of and quotation for the Company’s entire enlarged issued and paid-up share capital of RM43,885,000

comprising 438,850,000 shares on the ACE Market of Bursa Malaysia Securities Berhad was completed on 15 September

2015.

In conjunction with and as an integral part of the listing, the Company undertook a Public Issue of 87,790,000 new

ordinary shares of RM0.10 at an issue price of RM0.28 per ordinary share (“Public Issue”). Relevant details of the initial

public offering were set out in the Prospectus issued by the Company on 26 August 2015.

The gross proceeds from the Public Issue amounted to RM24.58 million and the status of the utilisation of the proceeds

raised as at 31 December 2016 was as follows:-

Description

Timeframe

for

Utilisation

Proposed

Utilisation

Actual

Utilisation

Deviation

Balance

to be

Utilised

RM’000 RM’000 RM’000

% RM’000

1.

Working capital

Within

24 months

12,881

10,574

–

–

2,307

2.

Research & Development

expenditure

Within

24 months

6,000

3,554

–

–

2,446

3.

Purchase of property, plant

and equipment

Within

24 months

2,000

498

–

–

1,502

4.

Marketing, branding

and promotion

Within

24 months

1,200

452

–

–

748

5.

Estimated listing expenses

Immediate

2,500

1,741

759

30.36

759

TOTAL

24,581

16,819

759

3.09

7,762

Note:-

^ The excess of RM 759,000 will be utilised for working capital purpose.

The utilisation of proceeds above should be read in conjunction with the Prospectus of the Company dated 26 August

2015. As stated in the Section 3.10.1 (e), page 27 of the Prospectus of the Company dated 26 August 2015:-

In the event if the actual listing expenses are higher than budgeted, the shortfall will be funded out of the portion

allocated for working capital. Conversely, if the actual listing expenses are lower than budgeted, the surplus will be

utilised for general working capital purposes.